CREDIT RESTORATION

CREDIT RESTORATION

|

Often, the "roadblock" to becoming a homeowner, whether you are a first time home buyer or otherwise, is a credit issue. As such, many choose to "Rent-To-Own" for credit reasons. For in a "Rent-To-Own", its not how good your credit is today that qualifies you (as it is when buying outright) but instead, how good your credit COULD be by the end of the lease/option term. Click here for more information regarding the Qualification process. Here at Rent-To-Own-MA.net, we want you to be able to own that 'Ideal Home' that you may dream of. So, we assist you in every step of the process, from finding the home, to getting you in the home and also in resolving any credit issues so you CAN own your 'Ideal Home'. |

|

BUT, WHAT HAPPENS IF YOU FAIL TO PRE-APPROVE ? 2 solutions: A lease purchase and credit restoration. For Rent-To-Own-MA.net is all about being able to get that 'Ideal Home' now ! No more renting and then having to move because you'd already be in the home that you wish to own. So, if you don't pre-appove for a mortgage, all is not lost for we can help you get your credit right to own that 'Ideal Home'. And not just only that either but also improving your credit and financial situation in many other ways too. SO, WITHOUT FURTHER ADO, WE INTRODUCE YOU TO ... |

(click on either of the above logos to learn more) |

|

Just who are UNITED CREDIT EDUCATION SERVICES (aka UCES) and FINANCIAL EDUCATION SERVICES (aka FES) ? |

|

United Credit Education Services (UCES) and Financial Education Services (FES) are both part of a company striving to provide financial opportunity in its most complete form. Their focus is on consumer education and to provide a unique personalized program to eliminate financial uncertainty and to create a plan of action to bring peace of mind in the future. Their vision is to continuously evolve beyond the financial services currently offered in order to enhance not only the opportunity to feel financial stability but also to help consumers achieve their greatest financial potential with their goals always leading back to what their foundation was built upon - the education and improvement of the financial scenarios of American consumers. To achieve these ends, over the past 10 years, they have created many financial programs to satisfy the need for financial security. They have covered the entire spectrum to create pieces for each part of the financial puzzle from maximizing credit potential to identity protection to securing assets to prepare for a stable financial future. UCES and FES are similar to us here at rent-to-own-MA.net (DR Investment Properties) in that we stand behind our services with integrity, always seek to educate our customers and always look for ways to improve. So, if you are looking for help in order to achieve that goal of owning your 'Ideal Home' or in improving any number of other financial scenarios, then read on and please feel free to click on any of the many links below to explore the world of services and programs that UCES and FES have to offer ... |

|

UCES PROTECTION PLAN - Protect Your Financial Future (click on any images to learn more) This is our core 'standard package' program, unlike any other financial service on the market and designed to cover all aspects of your financial portfolio. Raising scores and credit restoration/repair is only the "tip of the iceberg". There is so much more. The UCES Protection Plan includes the following products and services: Budgeting, Credit Restoration, Credit Builder, Credit Attorney, Credit Monitoring, Debt Payoff, Identity Monitoring, Life Insurance, Financial Lockbox, Net Worth, Savings Goals, MyCare Plan (will and trust) and the YFL (Youth Financial Literacy) Family Mint. Highlighted below are links to more information on some of these many features included in the UCES Protection Plan.

|

|

ADDITIONAL OPTIONS: In addition to the UCES Protection Plan, we have a few more 'standard package' programs:

|

|

What is listed above is just the basics. However, there is more, a lot more ... Not only can you restore and establish your credit and strengthen your financial future but you can also ... ... get PAID for it ! ... This is our 'premium package' program. It includes all of the 'standard package' FES Protection Plan products and services (plus life insurance) plus a very lucrative career opportunity ! To learn more about this opportunity, simply click on the link below and watch the videos ... ... or you can simply click on link below and ... |

|

Well, that's United Credit Education Services and Financial Education Services. Before moving on, we would like to point out 3 important FACTS about UCES/FES:

|

|

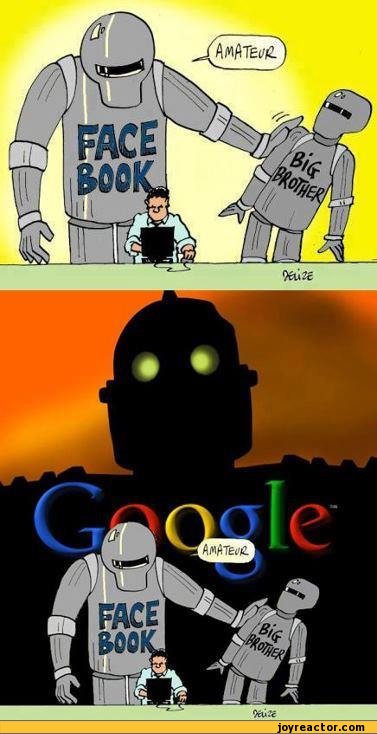

Before you leave this page, we would like to remind you that not every thought needs to be shared :-) or as it turns out : Posted or Tweeted. This is because lenders and other credit analysts are trending towards using your social media as data for determining your credit score and other risk factors for timely repayment. Example, is there mention of job loss or complaints about work? How about posting about being "wasted"? Party talk? Have your friends defaulted on loans? This will negatively impact you. "It turns out humans are really good at knowing who is trustworthy and reliable in their community," said Jeff Stewart, a co-founder and CEO of Lenddo. "What's new is that we're now able to measure through massive computing power." The power, reach and scrutiny of Facebook and other giant data collecting is un-nerving. Our advice? Use discretion when posting. No drunk texting or posting is always good advice. Once it is on the web, it is public data. |

So, if you are ready to solidify your credit and fortify your financial future ...CONTACT US |